Shrouded in the enigma of complex algorithms and unprecedented financial freedom, the world of cryptocurrency has been making waves in the global economy. From being an obscure concept born out of the mysterious mind of Satoshi Nakamoto, it has transformed into a trillion-dollar market. The surge in popularity is evident as investors, novice and veteran alike, are intrigued by its potential for massive returns. But treading these waters can be tricky without proper guidance. Hence this article – Best Bitcoin and Crypto ETFs to Buy Now.

Buckle up as we plunge deep into the digital universe brimming with Bitcoin, Ethereum, Ripple and more! We will chart a course through this cosmic wilderness – unveiling crypto ETFs that have caught our eye for their performance and potential growth. Whether you’re a daring explorer ready to conquer new investment terrain or a cautious bystander eager to understand before jumping in – this virtual voyage promises lucrative opportunities for all.

Understanding Bitcoin and Crypto ETFs

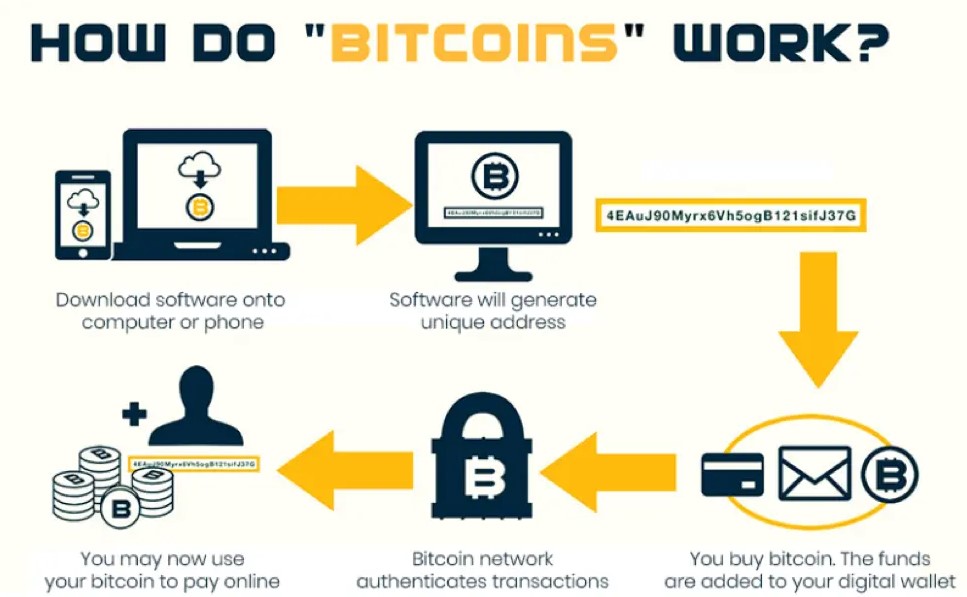

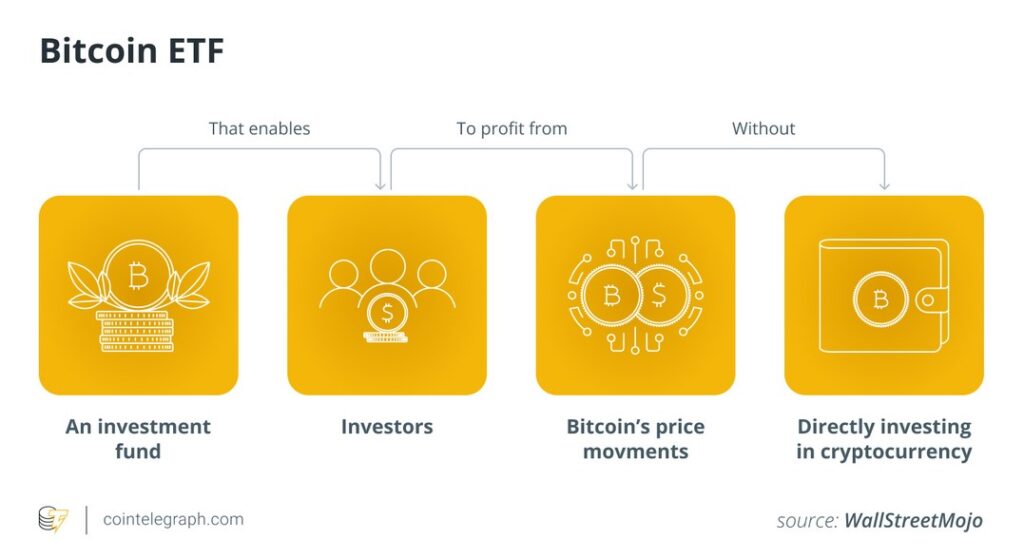

Bitcoin and Crypto ETFs (Exchange-Traded Funds) are financial products that track the value of cryptocurrencies like Bitcoin. They allow investors to gain exposure to the cryptocurrency market without actually owning any digital assets themselves. This can be advantageous for those who want to invest in cryptocurrencies but do not want to deal with the complexities of buying, storing, and securing these digital assets.

ETFs are traded on traditional stock exchanges, which means they are subject to stringent regulatory oversight. This can provide a level of security and peace of mind for investors who may be wary of the relatively unregulated nature of cryptocurrency markets. Furthermore, crypto ETFs offer diversification as they often track multiple cryptocurrencies, not just Bitcoin.

However, it’s important to note that investing in Bitcoin or Crypto ETFs still carries risk. The value of these funds is directly tied to the volatile cryptocurrency market. Therefore, while they provide a more accessible way for individuals to invest in cryptocurrencies, potential investors should still carefully consider their risk tolerance and investment goals before diving in.

Overview: Evolution of Bitcoin and Crypto ETFs

Bitcoin and crypto ETFs have come a long way since their inception. Bitcoin, the first cryptocurrency, was created in 2009 by an anonymous person (or group) known as Satoshi Nakamoto. For several years, Bitcoin remained a niche interest for tech enthusiasts and libertarians. However, as its value started to increase significantly around 2017, mainstream financial institutions began to take notice.

The idea of a Bitcoin or crypto ETF (Exchange Traded Fund) was first proposed around this time but initially met with regulatory resistance. The U.S Securities and Exchange Commission (SEC) expressed concerns about market manipulation and lack of regulation in the cryptocurrency markets. However, over time, as cryptocurrency markets matured and became more regulated, these concerns have lessened.

As of now, there are several Bitcoin and crypto ETFs available for investors in various countries around the world like Canada and Brazil. In October 2021, the first Bitcoin futures ETF was launched in the United States marking a significant milestone in the evolution of Bitcoin and crypto ETFs. This evolution reflects the growing acceptance of cryptocurrencies as a legitimate asset class among mainstream investors.

Benefits of Investing in Bitcoin and Crypto ETFs

Investing in Bitcoin and Crypto ETFs (Exchange-Traded Funds) offers several benefits. Firstly, they provide exposure to cryptocurrency markets without the need for you to directly buy, store or secure digital assets. This can significantly reduce the risk of loss from hacking or theft, which is a common concern with cryptocurrencies.

Secondly, Crypto ETFs are managed by professional fund managers who have extensive knowledge and experience in cryptocurrency trading. This means that they can potentially generate better returns than individual investors who lack such expertise. Lastly, as these are regulated financial products, they offer greater investor protection compared to direct cryptocurrency investments. They also allow for diversification within the crypto space itself which can help balance potential risks and rewards.

Secondly, Crypto ETFs are managed by professional fund managers who have extensive knowledge and experience in cryptocurrency trading. This means that they can potentially generate better returns than individual investors who lack such expertise. Lastly, as these are regulated financial products, they offer greater investor protection compared to direct cryptocurrency investments. They also allow for diversification within the crypto space itself which can help balance potential risks and rewards.

Top Bitcoin ETFs to Consider Buying Now

As of now, there are no Bitcoin ETFs available in the United States due to regulatory restrictions. However, there are several ETFs that provide indirect exposure to Bitcoin through holdings in companies involved in blockchain technology and cryptocurrency. These include the Amplify Transformational Data Sharing ETF (BLOK) and the Reality Shares Nasdaq NexGen Economy ETF (BLCN).

In Canada, though, there have been a few Bitcoin ETFs approved recently. The Purpose Bitcoin ETF (BTCC) was the world’s first physically settled Bitcoin ETF. It allows investors to buy shares backed by physical bitcoin held in secure storage without needing to worry about handling or safekeeping of Bitcoin. Another one is Evolve Funds Group Inc.’s Bitcoin ETF (EBIT), which also provides direct exposure to bitcoin.

Please note that investing in these types of funds should be done with caution as the value of cryptocurrencies can be highly volatile. Always do your own research or consult with a financial advisor before making investment decisions.

Best Cryptocurrency ETFs Worth Investing In

Investing in Cryptocurrency ETFs (Exchange-Traded Funds) can be an excellent way to diversify your portfolio while gaining exposure to the high potential upside of cryptocurrencies. However, as of now, there are no pure-play cryptocurrency ETFs available due to regulatory restrictions in many countries including the U.S.

That said, there are a few indirect ways to invest. The Grayscale Bitcoin Trust (GBTC) is a popular choice, as it tracks the price of Bitcoin and can be bought and sold like any other security on traditional exchanges. Another option is blockchain ETFs such as Amplify Transformational Data Sharing ETF (BLOK) or Reality Shares Nasdaq NexGen Economy ETF (BLCN). These funds invest in companies that use or significantly benefit from blockchain technology, which underpins most cryptocurrencies.

It’s important to note that investing in these types of assets can carry significant risk due to the volatile nature of cryptocurrencies. As always, investors should do their own research and consider seeking advice from a financial advisor before making investment decisions.

Tips for Choosing the Right Crypto ETF

Choosing the right Crypto ETF requires careful consideration and understanding of the cryptocurrency market. Firstly, it’s essential to understand your investment goals and risk tolerance. Cryptocurrencies are highly volatile, so you should be prepared for the possibility of significant swings in value. If you’re a conservative investor, a crypto ETF might not be the best choice for you.

Secondly, research is crucial. Look at the fund’s holdings and how they are allocated. Some crypto ETFs focus on one particular cryptocurrency like Bitcoin or Ethereum, while others offer exposure to a broad range of cryptocurrencies. Also, consider the ETF’s performance history and its expense ratio as these will directly affect your returns.

Lastly, consider seeking advice from financial advisors who have experience with cryptocurrency investments. They can provide valuable insights into which ETFs are performing well and align with your investment goals. Always remember that investing in any form of asset comes with risks, so make informed decisions based on thorough research and professional advice.

Risks Involved with Investing in Crypto ETFs

Investing in Crypto ETFs, like any investment, comes with its own set of risks. The most prominent risk is the inherent volatility of the cryptocurrency market. Cryptocurrencies are known for their dramatic price swings which can lead to significant gains or losses. This volatility can be influenced by factors such as regulatory news, technological changes, market demand and macroeconomic trends.

Another risk involves the lack of regulation and potential for fraud within the crypto industry. While ETFs are regulated investment products, the underlying assets (cryptocurrencies) operate in a largely unregulated market. This could potentially expose investors to fraudulent activities or manipulative practices that could impact their investments negatively. Furthermore, there’s also the risk associated with technology and security breaches as cryptocurrencies are digital assets stored and transacted online.

Lastly, investing in Crypto ETFs may carry liquidity risks. There may not always be an active market for a Crypto ETF to sell its shares when it needs to meet redemptions or reallocate its investments, which could impact an investor’s ability to exit their position when desired. Therefore, while Crypto ETFs offer a way for investors to gain exposure to cryptocurrencies without directly owning them, these risks need to be carefully considered before investing.

Top Performing Bitcoin ETFs

As of now, there are no officially recognized Bitcoin ETFs (Exchange-Traded Funds) in the U.S. due to regulatory concerns by the Securities and Exchange Commission (SEC). The SEC has repeatedly rejected proposals for Bitcoin ETFs citing risks associated with fraud and manipulation.

However, there are indirect ways to invest in Bitcoin through ETFs. For instance, some investors look at ETFs like the ARK Innovation ETF (ARKK), which holds significant positions in companies that are related to cryptocurrencies or have heavy blockchain exposure. Another example is the Grayscale Bitcoin Trust (GBTC), which operates more like a traditional investment trust but is often compared to an ETF. Please note that these options come with their own set of risks and should be considered carefully before investing.

Best Performing Crypto ETFs

As of now, there are no specific Crypto ETFs that are available due to regulatory hurdles. The U.S. Securities and Exchange Commission (SEC) has not approved any exchange-traded funds (ETFs) that hold cryptocurrencies directly. Therefore, it’s not possible to provide a list of best performing Crypto ETFs.

However, there are several blockchain-focused ETFs that investors can consider as an indirect way of investing in the crypto space. These include Amplify Transformational Data Sharing ETF (BLOK), Reality Shares Nasdaq NexGen Economy ETF (BLCN), and Innovation Shares NextGen Protocol ETF (KOIN). These ETFs invest in companies that are either developing blockchain technologies or are benefitting from them. Please note that the performance of these funds will not mirror the performance of cryptocurrencies directly and investing in them carries its own set of risks. Always do your own research before making investment decisions.

Factors to Consider When Buying ETFs

When buying Exchange-Traded Funds (ETFs), one of the primary factors to consider is the expense ratio. This refers to the cost of managing the fund as a percentage of its total assets. Lower expense ratios typically mean higher returns for investors, so it’s generally better to opt for ETFs with lower ratios.

Another important factor is liquidity. ETFs with high trading volumes are easier to buy and sell without impacting their price, making them more liquid and thus more attractive to many investors. You should also consider the index that the ETF tracks; some may track broad market indices while others might focus on specific sectors or regions.

Lastly, consider your investment goals and risk tolerance. If you are investing for the long term, you might want an ETF that tracks a broad market index for diversification purposes. On the other hand, if you have a high-risk tolerance and are looking for higher potential returns, sector-specific or thematic ETFs might be more suitable. Always remember that past performance is not indicative of future results, so thorough research and due diligence are crucial before purchasing any ETFs.

How to Buy Bitcoin and Crypto ETFs

Buying Bitcoin and Crypto ETFs (Exchange Traded Funds) is similar to buying shares of any other ETF or stock. First, you need to have an account with a brokerage that offers access to ETF trading. Brokerages like Robinhood, E*Trade, TD Ameritrade, and Charles Schwab are popular choices.

Before purchasing, research the different types of Crypto ETFs available. Some track the price of a single cryptocurrency like Bitcoin while others follow a diversified basket of cryptocurrencies. Each has its own risk and return profile. Once you’ve decided on which ETF to buy, simply search for its ticker symbol in your brokerage account and proceed with the transaction just as you would with any other investment.

Keep in mind that investing in cryptocurrencies and Crypto ETFs can be highly volatile and risky. It’s important to understand the risks involved before making such investments. Always consult with a financial advisor or do thorough research before making investment decisions.

Conclusion

In conclusion, it is evident that Bitcoin and Crypto ETFs present an exciting space for investors. These investment tools offer exposure to the promising world of cryptocurrencies while mitigating some of the risks associated with direct trading. They have opened up new corridors for both institutional and retail investors who prefer a more flexible, secure and regulated method of engaging in this thriving digital market.

As we cruise further into the unfolding era of digital currencies, your mission as an investor should not only be about following trends but understanding them. The clarity offered within Bitcoin and Crypto ETFs allows you to grasp these financial revolutions holistically from a safer distance than most dare to venture. So take a leap into tomorrow’s finance today by wisely considering these innovative investment vehicles!