Choosing the right accounting software for a small business can be a daunting task, but Xero stands out as a top contender in the market. With its flexible pricing plans and comprehensive features, Xero offers a solution that caters to businesses of all sizes. The starter plan provides essential accounting tools such as invoicing, bank reconciliation, and expense tracking, making it suitable for startups and solopreneurs. As businesses grow, they can upgrade to higher-tier plans that offer advanced features like multi-currency support and project tracking. This scalability makes Xero an attractive choice for companies looking to streamline their financial processes without overcommitting financially.

In addition to its robust accounting capabilities, Xero also integrates customer relationship management (CRM) tools into its platform. This allows users to manage customer interactions alongside their financial data, providing a holistic view of their business operations. Furthermore, the software’s user-friendly interface has garnered positive reviews from users who appreciate its intuitive design and ease of use. However, while Xero may be an excellent choice for many businesses, it’s important to consider alternatives such as QuickBooks or FreshBooks which offer similar functionalities with different pricing models or focus on specific niches like freelancers or service-based businesses.

Ultimately, when evaluating accounting software options like Xero, it’s crucial to consider not only pricing and features but also how well they align with your business needs and growth trajectory.

Overview of Xero accounting software

Xero accounting software is a powerful tool that has revolutionized financial management for businesses of all sizes. With its user-friendly interface and innovative features, Xero offers an efficient way to handle all aspects of accounting, from invoicing and bank reconciliation to payroll and expense tracking. One of the standout features of Xero is its integration with customer relationship management (CRM) systems, allowing businesses to seamlessly manage their financial data alongside customer information. This makes it easier to track sales, forecast revenue, and understand the financial impact of various marketing campaigns.

Furthermore, Xero’s cloud-based platform enables users to access their financial data anytime, anywhere, making it a convenient choice for modern businesses with remote workforces or multiple locations. The platform also allows for real-time collaboration among team members, ensuring that everyone is working with the most up-to-date information. Additionally, Xero integrates with numerous third-party applications such as payment gateways and inventory management systems, further enhancing its functionality and flexibility for diverse business needs.

In conclusion, Xero accounting software offers a comprehensive solution for managing financial operations while integrating seamlessly with CRM systems. Its user-friendly interface and cloud-based accessibility make it an attractive option for businesses looking to streamline their accounting processes and gain deeper insights into their financial performance. With its wide array of integrations and real-time collaboration capabilities, Xero stands out as a versatile tool that can adapt to the evolving needs of modern businesses in today’s dynamic market landscape.

Xero is a popular cloud-based accounting software designed for small and medium-sized businesses. It offers a range of features including invoicing, bank reconciliation, expense tracking, and financial reporting. One of the key advantages of Xero is its user-friendly interface and accessibility from anywhere with an internet connection.

The software also integrates with various third-party apps and services, allowing users to customize their accounting experience to suit their specific business needs. Additionally, Xero provides excellent customer support and training resources for users to get the most out of the platform. Overall, Xero is a powerful accounting solution that streamlines financial management for businesses of all sizes.

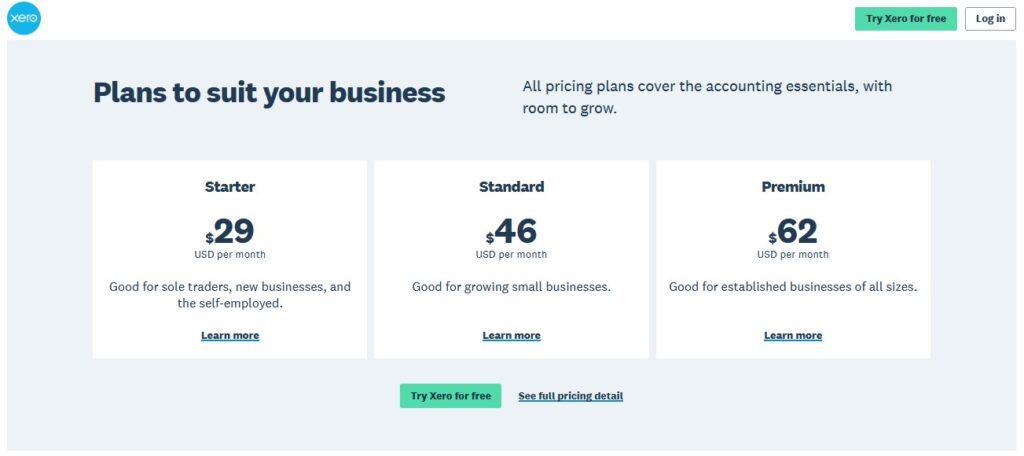

Xero Pricing: Breakdown of Xero’s pricing plans

Xero offers a variety of pricing plans to suit the needs of different businesses. The Starter plan is the most basic option, offering simple invoicing and bank reconciliation features. The Standard plan includes additional features such as payroll and multi-currency support, making it suitable for growing businesses. For larger organizations with more complex needs, the Premium plan offers advanced reporting and expense management tools.

Each pricing plan also comes with a different number of users and access levels, allowing businesses to choose the right option based on their size and requirements. It’s important for businesses to carefully evaluate their needs and budget in order to select the most appropriate Xero pricing plan for their operations. Additionally, Xero often runs promotions or offers discounts for new customers, so it’s worth keeping an eye out for any special deals that may be available.

As a small business owner, I was looking for an all-in-one solution that could seamlessly handle both my accounting and customer relationship management (CRM) needs. That’s when I came across Xero, a cloud-based platform known for its user-friendly interface and robust features. What appealed to me the most was the flexible pricing structure that Xero offers, catering to businesses of all sizes. The three main pricing plans – Starter, Standard, and Premium – each provide a different level of functionality to suit various business requirements.

The Starter plan is ideal for freelancers or very small businesses on a tight budget. At just $20 per month, it includes basic accounting features such as invoicing and bank reconciliation. Moving up to the Standard plan at $30 per month provides additional capabilities like expense claims and multi-currency support. Finally, the Premium plan at $40 per month offers advanced features such as project tracking and enhanced reporting tools. Furthermore, the CRM integration offered by Xero allows seamless customer data management while staying within your budget constraints.

Overall, I found Xero’s pricing plans to be transparent and affordable compared to other similar platforms in the market. With its emphasis on both accounting and CRM functionalities combined with reasonable prices, Xero has proven itself to be an attractive option for businesses looking for comprehensive financial management solutions without breaking the bank.

Xero Features: Key features of Xero accounting software

Xero accounting software has revolutionized the way businesses manage their financial operations through its key features. One of the standout features of Xero is its customer relationship management (CRM) capabilities, which allow users to maintain detailed records of customer interactions and transactions in a centralized system. This feature enables businesses to enhance their customer service and tailor their marketing efforts based on valuable insights gathered from CRM data. With Xero’s CRM functionality, businesses can build stronger relationships with their customers and drive growth by leveraging data-driven strategies.

Furthermore, Xero’s robust accounting features provide users with comprehensive tools for managing finances efficiently. The software offers a range of accounting capabilities such as invoicing, bank reconciliation, expense tracking, and financial reporting. These features enable small and medium-sized enterprises to streamline their financial processes and gain greater visibility into their cash flow and performance. Additionally, Xero’s intuitive interface makes it easy for users to navigate through various accounting tasks, ensuring that they can stay on top of their financial responsibilities without unnecessary complexity or confusion.

In conclusion, Xero’s key features offer a powerful combination of CRM and accounting functionalities that empower businesses to optimize their operations effectively. By leveraging these features, companies can unlock new opportunities for growth while maintaining strong relationships with customers through personalized interactions based on meaningful data insights. Ultimately, Xero stands out as an indispensable tool for modern business owners seeking to elevate their financial management practices and enhance customer satisfaction simultaneously.

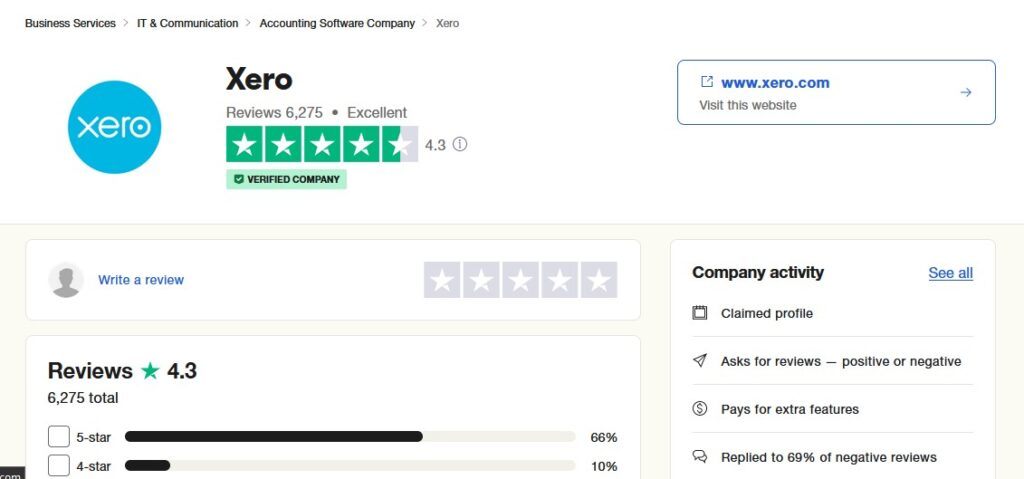

Xero Reviews: User and expert reviews of Xero

As a small business owner, finding the right accounting software is crucial for managing finances and staying organized. After thorough research and testing, I turned to Xero for its intuitive interface and robust features. User reviews of Xero consistently laud its user-friendly CRM capabilities, which allow for seamless client management and communication. The ability to track customer interactions, manage leads, and streamline sales processes has been a game-changer for my business. In addition, expert reviews of Xero have highlighted its powerful accounting tools that make invoicing, bank reconciliation, and financial reporting a breeze.

One standout feature that both users and experts praise in Xero is its integration with other business applications. By syncing with popular apps like PayPal, Shopify, and Square, Xero simplifies the process of managing transactions from various channels. This level of flexibility has significantly improved my workflow by automating data entry tasks and providing real-time insights into cash flow. Furthermore, the collaborative nature of Xero allows team members to work together in real time on financial documents without any version control issues or delays. This has enhanced efficiency within my organization as we can easily share information and work on projects simultaneously without missing a beat.

In conclusion, the user and expert reviews of Xero have resonated with my own experience as a small business owner seeking comprehensive CRM solutions alongside powerful accounting tools. The positive feedback from fellow users about its ease of use aligns with my own impressions while utilizing the platform daily to handle clients’ needs effectively.

Xero Alternatives: Comparison with other accounting software options

When it comes to managing finances and customer relationships, the right accounting software can make a world of difference. While Xero has gained popularity for its user-friendly interface and robust features, there are several alternatives worth considering for businesses looking for a different approach. One such alternative is QuickBooks, which offers a comprehensive suite of accounting tools coupled with customer relationship management (CRM) capabilities. With QuickBooks, users can easily track sales leads, manage customer information, and create customized reports that provide insights into both financial and customer data. This seamless integration of CRM and accounting functionalities sets QuickBooks apart as a compelling alternative to Xero.

Another noteworthy competitor in the realm of accounting software is FreshBooks, which caters specifically to small business owners seeking an intuitive platform for managing their finances while also maintaining strong client relationships. FreshBooks stands out with its emphasis on invoicing and time tracking features that streamline billing processes while also offering basic CRM tools to help businesses stay connected with their customers. Its user-friendly design makes it easy for individuals without an accounting background to navigate the platform effectively. By comparing these alternatives alongside Xero’s offerings, businesses have the opportunity to evaluate which solution aligns best with their specific needs and goals in terms of both accounting management and client engagement.

In conclusion, while Xero continues to be a popular choice for many businesses due to its versatility in handling financial operations, there are viable alternatives available that offer unique combinations of accounting features alongside robust CRM capabilities.

Conclusion

In conclusion, Xero emerges as a robust and user-friendly accounting software designed to streamline financial operations for businesses of all sizes. Its competitive pricing structure, coupled with an extensive range of features such as expense tracking, invoicing, and bank reconciliation, makes it a top choice for entrepreneurs seeking efficient solutions. The positive user reviews attest to its reliability and ease of use, further solidifying its position in the market.

As we explore alternatives to Xero, it’s important to note that each option comes with its own set of unique benefits and drawbacks. QuickBooks Online offers tight integration with other Intuit products and is a popular choice among small business owners. FreshBooks presents a simplified interface tailored towards freelancers and service-based businesses. Ultimately, the key lies in identifying the specific needs of your business before making an informed decision about which accounting software best aligns with your goals.